Did you know that the total value of India’s real estate market is projected to reach a staggering $1 trillion by 2030? This jaw-dropping figure, highlighting the immense growth potential of the sector, makes the NIFTY Realty Index an essential tool for understanding India’s evolving economic landscape. Whether you’re an investor, a developer, a homeowner, or simply curious about India’s growth story, this index provides a window into the dynamism and potential of the real estate sector.

As a benchmark of the leading real estate companies listed on the National Stock Exchange of India (NSE), the NIFTY Realty Index captures the pulse of this critical industry. It reflects the ebb and flow of housing demand, infrastructure development, urbanisation trends, and policy changes – all forces shaping the sector’s trajectory.

In this exploration, we will dissect the composition of the NIFTY Realty Index, trace its historical performance, and examine the key catalysts fueling the industry’s expansion. By unravelling its investment potential and weighing the associated risks and rewards, you’ll better appreciate this index and its vital role in India’s booming real estate narrative. This knowledge will equip you to navigate the complexities and opportunities within the sector confidently.

What is the Nifty Realty Index?

An index is a benchmark composed of many stocks for a specific purpose. It can be considered an imaginary stock (which can’t be traded) consisting of various individual companies, each with a particular weightage to track all the companies in one go. There are many indices on the NSE and the BSE, such as the Nifty 50 ( The benchmark of the Indian stock market), Sensex ( Similar to Nifty but by the BSE), Banknifty (Tracking the Indian banks) and several other sector-based, goal-based indices. The Nifty Realty Index tracks India’s Real Estate sector. The Nifty Realty Index is designed to reflect the behaviour and performance of real estate companies in the financial market.

The Nifty Realty Index comprises ten tradable, exchange-listed real estate companies. This index serves multiple functions, including serving as a benchmark for fund portfolios and enabling the launch of index funds, ETFs, and structured products. The Nifty Realty Index holds significant value as an investor whether you’re actively rotating capital across sectors or prefer a long-term buy-and-hold strategy.

The subsequent paragraph delves into the methodology behind the index’s calculation. Feel free to skip this section if it’s irrelevant to your interests.

Calculation of the Index

The NIFTY Realty Index, similarly, is calculated using the free-float market capitalization-weighted methodology. This implies that the index’s value mirrors the total market value of the constituent companies’ readily tradable shares (free-float market capitalisation).

The weightage of each company within the index is determined by its free-float market capitalisation relative to the total free-float market capitalisation of all companies in the index. However, to maintain balance and prevent over-concentration, specific caps are implemented. No stock can exceed a weightage of 33%, and the combined weightage of the top three stocks is capped at 62%.

The index undergoes semi-annual rebalancing in March and September. This process ensures that the index accurately reflects the prevailing market conditions and the relative performance of the real estate companies. During rebalancing, individual company weights may be adjusted based on market capitalisation, thus preserving the index’s relevance and accuracy.

Constituents Sectors in Realty Space

The NIFTY Realty Index is a barometer for the Indian real estate industry’s overall performance. However, its value is intrinsically linked to a complex and multifaceted value chain. This chain comprises diverse activities and stakeholders, each contributing significantly to the industry’s success and, consequently, the index’s performance.

Land Acquisition and Development:

The bedrock of any real estate project is the acquisition and development of suitable land. This stage involves identifying viable land parcels, conducting due diligence, obtaining necessary approvals, and preparing the land for construction. The efficiency and success of this stage can significantly impact a company’s profitability and, in turn, influence the NIFTY Realty Index.

Design and Planning:

Once the land is secured, architects and engineers collaborate to design and plan the project. This phase entails conceptualising the building’s structure, layout, and aesthetics while ensuring compliance with building codes and regulations. Innovative and sustainable designs can enhance a project’s marketability and contribute to its long-term value.

Construction and Project Execution:

The construction phase brings the project to life. It involves mobilising resources to build the structure, including labour, materials, and equipment. Efficient project management and adherence to timelines are crucial to avoid cost overruns and delays that can negatively affect a company’s financials.

Marketing and Sales:

Real estate companies employ marketing and sales strategies to attract buyers or tenants once the project is nearing completion or ready for occupancy. Effective marketing and sales efforts are essential for generating demand and maximising revenue.

Property Management and Maintenance:

After the sale or lease, property management and maintenance become crucial for ensuring tenant satisfaction and preserving the property’s value. This includes handling repairs, upkeep, and tenant relations.

Financing and Investment:

The real estate sector relies heavily on financing and investment. Developers secure funding from banks, financial institutions, or private investors to finance their projects. The availability and cost of capital significantly impact the industry’s growth and the index’s performance.

Each of these stages is interconnected and interdependent. Any disruption in one part of the value chain can have cascading effects throughout the industry, potentially impacting the NIFTY Realty Index. For instance, a delay in obtaining construction permits, a surge in raw material prices, or a change in government policies related to real estate can all affect the performance of real estate companies and the index.

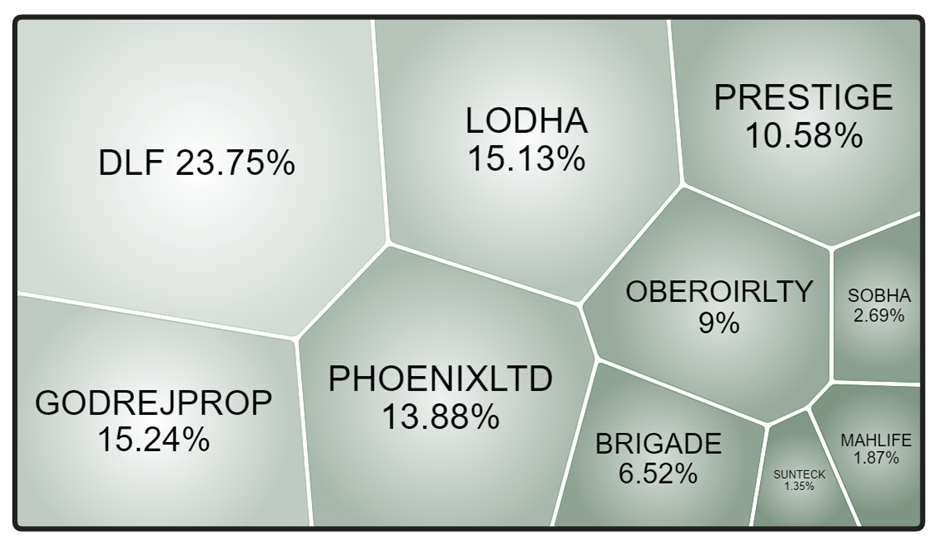

Constituent Stock Weights of the Nifty Infrastructure Index:

| S.no | Name | Weightage |

| 1. | DLF Ltd | 23.75% |

| 2. | Godrej Properties | 15.24% |

| 3. | Lodha | 15.13% |

| 4. | Phoenix Ltd | 13.88% |

| 5. | Prestige | 10.58% |

| 6. | Oberoi Realty | 9% |

| 7. | Brigade | 6.25% |

| 8. | Sobha | 2.69% |

| 9. | Mahlife | 1.87% |

| 10. | SunTeck | 1.35% |

Understanding the intricacies of the real estate value chain is crucial for interpreting the movements of the NIFTY Realty Index. By recognising the interplay of these various stages and stakeholders, investors can gain deeper insights into the factors driving the index’s performance.

The Weightage of stocks can change depending on the market capitalization of the companies at that point of time.The weightage of each of the stocks can be checked by visiting the NSE’s official website:

Historic Performance of Nifty Realty Index

The chart shows that the Nifty Realty index has exhibited a volatile yet ultimately rewarding journey since its inception. Distinct growth, stagnation, and recovery phases offer valuable insights into the real estate sector’s evolution.

Stagnation and Consolidation (2013-2015):

- Policy Uncertainty and Regulatory Changes: The period leading up to and following the 2014 general elections was marked by some policy uncertainty and anticipation of regulatory changes in the real estate sector. This likely contributed to a cautious sentiment among investors and developers, leading to a period of consolidation in the index.

- Rising Interest Rates: The Reserve Bank of India’s efforts to curb inflation during this period resulted in a gradual increase in interest rates. This made home loans more expensive, potentially impacting demand and contributing to the stagnation in the index.

- Inventory Overhang: A buildup of unsold inventory in specific markets also puts downward pressure on prices and limits the index’s upward potential.

Stagnation and Decline (2015-2020):

- Policy Changes and Regulatory Tightening: The implementation of the Real Estate (Regulation and Development) Act (RERA) and the Goods and Services Tax (GST) brought about greater transparency and accountability but also led to a temporary slowdown in the market as developers adjusted to the new norms.

- Demonetization and Economic Slowdown: Demonetization in 2016 and a subsequent economic slowdown dampened investor sentiment and impacted real estate transactions.

- Non-Performing Assets (NPAs) in the Banking Sector: The rising NPAs in the banking sector, particularly in real estate loans, further tightened credit availability and affected project financing.

Sharp Recovery and Growth (2020-2023):

- COVID-19 Pandemic and Policy Stimulus: The pandemic initially disrupted the real estate market, but subsequent government stimulus measures, including lower interest rates and stamp duty cuts, reignited demand.

- Shift in Consumer Preferences: The pandemic also prompted a shift in consumer preferences towards larger homes and integrated townships, benefiting developers with projects catering to these needs.

- Work-from-Home Culture: The rise of remote work increased demand for residential properties in suburban areas and smaller towns as people sought more spacious and affordable housing options.

Additional Factors (Throughout the Period):

- Urbanization and Population Growth: India’s rapid urbanisation and growing population drive long-term demand for housing and commercial real estate.

- Foreign Investment: Increased foreign investment in the Indian real estate sector has provided a significant boost, particularly in commercial and office spaces.

- Technological Advancements: Adopting technology in real estate, such as proptech solutions and online property platforms, enhances efficiency and transparency, attracting more buyers and investors.

Performance against Nifty 50

Divergence in Performance:

The chart illustrates a distinct contrast in performance trajectories between the Nifty Realty and Nifty 50 indices. While the Nifty 50 has exhibited a consistent upward trend over the observed period, the Nifty Realty index has experienced periods of stagnation and volatility, with its overall growth lagging behind the broader market. This divergence can be attributed to several factors unique to the real estate sector:

Cyclical Nature of Real Estate: Real estate is inherently cyclical and susceptible to economic fluctuations. Periods of economic slowdown or policy changes can disproportionately impact the sector, leading to subdued growth or even declines in the Nifty Realty index.

Regulatory and Policy Impacts: Government policies and regulations heavily influence The real estate sector. Policy changes like demonetisation, RERA implementation, and GST introduction have caused disruptions and uncertainties, impacting investor sentiment and the index’s performance.

Interest Rate Sensitivity: While both indices are affected by interest rates, the real estate sector is susceptible to changes. Rising interest rates can make home loans less affordable, dampening demand and impacting the index.

Project Execution and Delays: Project delays, cost overruns, and issues related to land acquisition and approvals can negatively impact the profitability of real estate companies, affecting the index’s performance.

Notable Divergences:

Post-Pandemic Recovery: While both indices recovered after the initial pandemic shock, the Nifty 50 rebounded more sharply. This could be attributed to factors such as the resilience of the IT and services sectors, which have a higher weightage in the Nifty 50 compared to the real estate sector’s slower recovery due to project delays and lingering uncertainties.

Important Considerations:

Volatility: The Nifty Realty index tends to be more volatile than the Nifty 50 due to the cyclical nature of the real estate sector and its susceptibility to policy changes and economic fluctuations.

Long-Term Potential: Despite the volatility, the Indian real estate sector holds significant long-term growth potential due to urbanization, rising incomes, and infrastructure development. Investors with a long-term horizon may find opportunities in the Nifty Realty index.

Overall, the chart highlights the distinct characteristics of the real estate sector and its impact on the Nifty Realty index. While the index may not always keep pace with the broader market, it offers the potential for significant returns over the long term for investors who understand its unique dynamics and risk factors.

Rolling Returns

Company Specific Analysis

DLF Ltd:

As India’s largest real estate developer, DLF commands a dominant presence in the market. Its diversified portfolio spans residential, commercial, and retail segments, catering to various customer needs. DLF’s strategic focus on premium and luxury developments in prime locations has enabled it to maintain its market leadership. The company’s strong brand reputation and focus on sustainable development practices further enhance its appeal to investors.

Godrej Properties:

Godrej Properties is known for its commitment to innovation, sustainability, and customer-centricity. The company develops premium residential and commercial projects in key urban centres across India. Godrej Properties’ strong brand image and focus on design excellence and timely project delivery have contributed to its consistent growth.

Lodha:

Lodha Group is recognised for its ambitious and large-scale projects, particularly in the Mumbai Metropolitan Region. The company’s focus on creating integrated townships and luxury developments has attracted significant investor interest. Lodha’s ability to execute complex projects and cater to the evolving needs of discerning homebuyers positions it for continued growth in the premium segment.

Phoenix Mills:

Phoenix Mills is a leading retail-led mixed-use development space player. The company’s iconic malls and commercial complexes in major cities have established it as a dominant force in the retail real estate segment. Phoenix Mills’ focus on creating vibrant and experiential destinations has contributed to its success and resilience, even in the face of e-commerce challenges.

Prestige Estates Projects:

Prestige Estates is a diversified real estate developer with a presence across residential, commercial, retail, and hospitality segments. The company’s strong project execution capabilities focus on quality, and customer satisfaction have enabled it to maintain a competitive edge. Prestige Estates’ pan-India presence and its ability to cater to diverse customer needs further enhance its growth prospects.

Macroeconomic Factors(Risks and Opportunities to Consider Before Investing)

Understanding the macroeconomic landscape is essential for anyone involved in the real estate market or considering investing in the Nifty Realty Index. Several key factors can influence its performance, presenting both risks and opportunities.

- Economic Growth: India’s GDP growth rate directly impacts demand for real estate. A robust economy spurs job creation, income growth, and urbanisation, driving demand for residential and commercial properties.

- Interest Rates: Interest rates are crucial for the real estate sector. Lower interest rates make home loans more affordable, stimulating demand and boosting the index. Conversely, rising rates can dampen demand and negatively impact the index.

- Government Policies: Government policies play a pivotal role. Favourable policies like tax incentives for homebuyers, infrastructure investment, and affordable housing initiatives can positively impact the sector and the index. However, unfavourable policies or regulatory tightening can create headwinds.

- Infrastructure Development: Investments in infrastructure like roads, railways, airports, and urban development projects can significantly influence the real estate market. Improved connectivity and accessibility enhance property values and attract investments, positively impacting the index.

- Demographics: India’s demographics, with a large young and growing population, present a significant opportunity for the real estate sector. Increasing urbanisation and the rising middle-class fuel housing demand, potentially driving the index’s growth.

- Credit Availability: Easy access to credit, particularly home loans, stimulates real estate purchases and can positively impact the index. However, tightening credit conditions or rising non-performing assets in the banking sector can adversely affect demand.

- Global Economic Conditions: The global economic landscape can indirectly influence the Indian real estate market. A slowdown in major economies can impact foreign investment and business sentiment, while a worldwide recovery can create favourable conditions.

- Regulatory Changes: Regulatory changes in the real estate sector, such as RERA and GST, can influence transparency, accountability, and ease of business. While these changes can promote long-term stability, they may also lead to short-term adjustments in the market.

- Inflation: Inflation erodes the value of money and can impact construction costs, property prices, and affordability. High inflation can dampen demand and negatively impact the index.

Current Events Affecting the Nifty Realty Index

- Rising Interest Rates: The Reserve Bank of India’s efforts to control inflation have increased interest rates, making home loans more expensive. This could potentially dampen demand for real estate and impact the index negatively.

- Economic Slowdown Concerns: Lingering concerns about a global economic slowdown, particularly in significant economies, can impact investor sentiment and lead to cautiousness in the real estate market, affecting the index’s performance.

- Inflationary Pressures: Persistent inflation can impact construction costs and affordability, making real estate less attractive to potential buyers. This can negatively affect the index’s performance.

- Regulatory Changes: Changes in regulations related to the real estate sector, such as revisions to RERA or GST, can create uncertainties and impact the operational environment for developers. Adapting to new regulations may also lead to short-term disruptions.

- Supply Chain Disruptions: The lingering effects of global supply chain disruptions can lead to delays in construction projects and increased costs for developers, potentially impacting the index.

- Shift towards Sustainable and Green Building: The growing emphasis on sustainable and green building practices creates opportunities for developers with projects that meet these criteria. Companies that fail to adapt to these changing preferences may face challenges.

- Geopolitical Tensions: Ongoing geopolitical tensions, such as the Russia-Ukraine conflict, can create economic uncertainties and negatively impact investor sentiment in the real estate market, affecting the index’s performance.

- Rural Demand: The resilience of the rural economy and the government’s focus on rural development can drive demand for real estate in smaller towns and rural areas, potentially benefiting companies in these markets.

Risks of Investing in the Nifty Realty Index

While the Nifty Realty Index presents attractive investment opportunities due to its connection to India’s growing economy and urbanisation, it is essential to be aware of the inherent risks involved:

Economic Volatility:

The real estate sector is susceptible to economic cycles. Economic downturns or slowdowns can lead to reduced property demand, declining property values, and decreased profitability for real estate companies. This can negatively impact the index.

Interest Rate Risk:

Changes in interest rates can significantly affect the real estate market. Rising interest rates increase the cost of borrowing, making home loans less affordable and potentially dampening demand. This can negatively impact the index’s performance.

Regulatory Changes:

The real estate sector is subject to various regulations and policies. Changes in these regulations, such as stricter environmental norms, land acquisition laws, or zoning regulations, can impact project costs and timelines, affecting the profitability of real estate companies and the index.

Market Risk:

Real estate markets can be volatile, and property prices can fluctuate due to various factors such as economic conditions, investor sentiment, and supply-demand dynamics. These fluctuations can impact the value of investments in real estate companies and the index.

Credit Risk:

For developers, the risk of buyers defaulting on payments or delays in project completion can lead to financial difficulties. This can negatively impact the company’s financial health and, consequently, the index.

Over Supply Risk:

An oversupply of properties in specific markets can lead to a decline in prices and rental yields, affecting the profitability of real estate companies and the index.

Liquidity Risk:

Real estate investments can be less liquid than other asset classes, particularly in physical properties. Selling a property can take time and involve transaction costs, potentially impacting investor returns.

Natural Disasters and Unforeseen Events:

Natural disasters such as earthquakes, floods, or pandemics can disrupt the real estate market, causing damage to properties, delays in construction, and affecting demand. This can hurt the index.

Geopolitical Risks:

Geopolitical tensions and uncertainties can impact investor sentiment and create volatility in the real estate market, affecting the index’s performance.

Risk Mitigation Strategy

Given its link to India’s economic growth and urbanisation, the Nifty Realty index can offer compelling returns. However, a proactive risk mitigation strategy is crucial to navigate the inherent uncertainties and potential volatility of the real estate sector:

Diversification:

Avoid over-concentration by investing in a diversified portfolio of real estate stocks representing different residential, commercial, and retail segments. This diversification spreads your risk and reduces the impact of any single company’s underperformance. Consider investing in Exchange Traded Funds (ETFs) that track the Nifty Realty index for instant diversification across a basket of real estate companies.

Thorough Research:

Conduct in-depth research on individual real estate companies and the overall market before making investment decisions. Analyse the company’s financial health, project pipeline, management quality, and growth prospects. Understand the regulatory environment, economic trends, and location-specific risks that could impact the sector.

Long-Term Perspective:

Real estate investments typically require a long-term horizon to realise their full potential. Adopt a patient approach to ride out short-term market fluctuations and benefit from the sector’s growth over time. The Nifty Realty index, historically, has shown resilience and potential for long-term appreciation.

Stay Informed:

Stay updated on industry trends, regulatory changes, macroeconomic developments, and company-specific news. This helps you anticipate potential risks and opportunities, enabling you to make informed investment decisions.

Professional Guidance:

If you are new to real estate investing or seek expert insights, consider consulting a qualified financial advisor with expertise in the real estate sector. They can help you create a personalised investment plan aligned with your risk tolerance, financial goals, and investment horizon.

Regular Monitoring:

Regularly monitor your investments to ensure they align with your objectives and risk tolerance. Rebalance your portfolio periodically to maintain your desired asset allocation and stay on track with your financial plan.

Adopting these risk mitigation strategies can enhance your chances of success while investing in the Nifty Realty Index. Remember, investing in real estate requires a disciplined and informed approach. With careful planning, research, and regular monitoring, you can navigate the inherent risks and potentially reap the rewards of this dynamic and growing sector.

Options to Invest in the Index

- Motilal Oswal Nifty Realty ETF: The scheme seeks to provide returns that, before expenses, closely correspond to the total returns of the securities as represented by the Nifty Realty Total Return Index, subject to tracking error.

- Expense Ratio:0.40%

- Fund Size:₹50Cr

- HDFC Nifty Realty Index Fund: The scheme seeks to generate commensurate returns (before fees and expenses) with the NIFTY Realty Index (T RI) performance, subject to tracking error.

- Expense ratio:0.40%

- Fund Size:₹115.06 Cr

- Tata Nifty Realty Index Fund: The scheme seeks to provide returns, before expenses, that commensurate with the performance of Nifty Realty (T RI), subject to tracking error. There is no assurance or guarantee that the scheme’s investment objective will be achieved. The scheme does not assure or guarantee any returns.

- Expense Ratio: 0.34%

- Fund Size:₹76.24 Cr

Events in the past that impacted the index

Case Study 1: The 2016 Demonetization Drive

The sudden demonetisation of high-value currency notes in 2016 sent shockwaves through the Indian economy, including the real estate sector. The Nifty Realty Index experienced a sharp decline as cash transactions, which were prevalent in the industry, reached a near standstill. Property sales and new project launches were significantly impacted, creating a temporary slump in the index.

Reasons for the Eventual Recovery:

- Increased Transparency: Demonetization, while disruptive, brought greater transparency to the real estate sector by curbing the flow of unaccounted cash. This long-term benefit enhanced investor confidence and attracted more formal investments into the industry.

- Lower Interest Rates: In response to the economic slowdown following demonetisation, the Reserve Bank of India lowered interest rates, making home loans more affordable. This and government initiatives to boost the housing sector revived demand and supported the index’s recovery.

- Shift towards Digital Transactions: Demonetization accelerated the adoption of digital payments in the real estate sector, improving transparency and transaction efficiency.

Case Study 2: The 2020 COVID-19 Pandemic

The COVID-19 pandemic initially caused a sharp decline in the Nifty Realty Index as economic activity halted and construction projects were stalled. However, the sector demonstrated remarkable resilience and staged a strong rebound, driven by various factors.

Reasons for the Strong Rebound:

- Policy Stimulus: The government introduced measures to support the real estate sector, including lower interest rates, stamp duty cuts, and relaxation of specific regulations. These measures stimulated demand and boosted the index.

- Shift in Consumer Preferences: The pandemic shifted consumer preferences towards larger homes, independent houses, and integrated townships. This benefited developers with projects catering to these evolving needs.

- Work-from-Home Culture: The rise of remote work increased demand for residential properties, particularly in suburban areas and smaller towns, as people sought more spacious and affordable housing options.

- Pent-up Demand: The pent-up demand built up during the initial lockdown period, coupled with attractive pricing and incentives, further fueled the market’s recovery.

Other Notable Events:

- Implementation of RERA (2016): The Real Estate (Regulation and Development) Act brought greater transparency, accountability, and consumer protection to the sector, boosting investor confidence and long-term stability.

- Introduction of GST (2017): The Goods and Services Tax streamlined the tax system for the real estate sector, reducing complexities and improving compliance.

- Infrastructure Development: Continuous investments in infrastructure projects across India have played a significant role in unlocking the potential of various regions and driving real estate growth, positively impacting the index.

Conclusion

In conclusion, the NIFTY Realty Index is a crucial indicator of India’s real estate industry, reflecting its health, potential, and overall growth trajectory. As we’ve explored, the index is not merely a collection of stock prices but a dynamic reflection of the intricate value chain that drives the sector – from land acquisition and development to construction, marketing, and property management.

The index’s historical performance is a testament to the sector’s resilience and adaptability, showcasing its ability to navigate regulatory changes, economic fluctuations, and the recent COVID-19 pandemic. While the index has faced stagnation and decline, it has consistently demonstrated its capacity to rebound and capitalise on emerging opportunities.

Looking ahead, the future of the NIFTY Realty Index appears promising. The industry’s growth drivers, including rapid urbanisation, a growing middle class, increasing infrastructure investments, and supportive government policies, all point towards a positive outlook. However, investors must remain mindful of potential risks, such as rising interest rates, global economic uncertainties, and regulatory changes.

Understanding the NIFTY Realty Index is crucial for investors, analysts, and industry participants. It offers valuable insights into the real estate sector’s dynamics, trends, and investment potential. As India continues its journey towards becoming a global economic powerhouse, the NIFTY Realty Index will remain a vital indicator of the industry’s progress and prosperity.